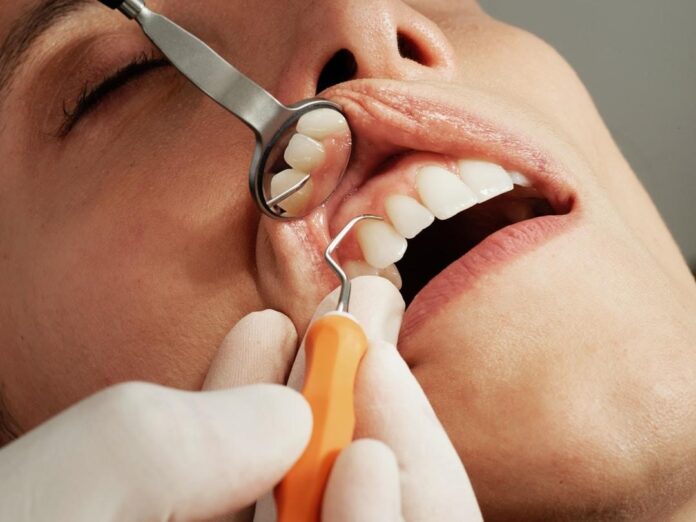

While we know the importance of health insurance to take care of ourselves physically, oral health is just as important. Having the right dental coverage can help address any needs that you or your family members have to make sure your smile not only shines bright but also maintains strength. Here are some things to look for when shopping for a dental plan and making sure that you’re working with the right insurer.

What is dental coverage?

Taking care of your dental health is crucial to your overall health. Dental insurance makes sure that the needs of you and your family members are properly covered. A dental cover is generally a form of extra cover that can be added to your private health insurance policy. As part of your insurance plan “extras,” you may have cover for preventative dental care like cleaning and checkups. To stay on top of your oral health, you should visit the dentist once or twice a year. Dental coverage helps take care of those routine visits and even offers some assistance with larger procedures like tooth extraction.

Dental cover usually falls under two categories: general dental and major dental. General dental refers to the basics like routine cleanings, fluoride treatments, X-rays, teeth bleaching, and small fillings. Some of this work is considered preventative. Major dental is designed to take on the big stuff like crowns and dentures. This coverage might also cover any need for braces and root canal surgery depending on the insurance company and coverage.

Terms and Conditions To Look Out For

The level of coverage you want is the first step in choosing a dental plan, but there are other factors to consider before locking down these insurance policies. This coverage comes with per-person limits, and you’ll likely have a maximum amount that each person can claim per year on a dental policy. If you’re purchasing a plan for a family, you may want to make sure you know the limit and weigh it with your dental needs. Dental coverage is included in your extra cover, so be sure to explore what other essential health benefits you may have protection for on a health insurance plan.

If you’ve never purchased dental coverage before, make sure that you aren’t caught off guard. Health funds may cap dental treatment discounts. Percentage benefits give a percentage of your treatment bill back to you. A set benefit plan will charge you a set amount for different treatments, regardless of what the dentist charges. Many insurance companies will use a combination of these two to avoid any unexpected expenses popping up.

Determining Level of Coverage

A dental cover comes with a waiting period, designed to make sure that people don’t only take out insurance policies when they need to cover larger procedures. Waiting periods for major dental plans depend on the treatment, with lengthier periods for more complex work like root canals and crowns, and shorter periods for preventative care. Knowing the type of dental care you may want in the future is the best way of figuring out the level of coverage you need.

You can choose the right level of dental coverage for your current needs and evaluate plans down the line to expand or retract based on your dental needs and budgetary needs. Your age, family members, and other factors will all impact how much cover you need and are even eligible for in the long run. Be sure to explore your options during the open enrollment period, and get a sense of what dental plan is right for you and your family’s dental needs.

Also Read Orthodontist